New Alcohol Duty Rates 2025 & the Impact on your Business

On Wednesday 30th October, the Chancellor delivered the new Labour Government’s first budget. Included in the budget was an update on Alcohol Duty legislation:

KEY POINTS

- On 1st February 2025, alcohol duty on non-draught products will increase in-line with the 2nd quarter 2025 forecasted RPI inflation rate of 3.65%.

- The temporary easement of wine alcohol duty bands will cease on 1st February 2025.

WHAT IS THE PURPOSE OF THE NEW DUTY TAX BANDS?

On 1st August 2023 a new alcohol duty legislation went live, marking the first increase in Alcohol duty in the UK since February 2019. The aim of this new legislation was to introduce standardised alcohol duty bands across all types of alcoholic products, (beer, spirits, cider, still and sparkling wines, as well as other fermented beverages), with all tax rates calculated based on the litres of pure alcohol in the product, applied from 0.1% upwards. This change reduced the number of tax bands on non-draught products from 15 to 8, which should make it simpler on paper, but in practice it has made the calculation and provision for duty far more complex. Within each tax band, the associated duty rate is used to calculate different tax charges for each 0.1% ABV increment on the label, which means that a 75cl bottle of wine with an ABV of 11% will incur a different duty tax to one with an ABV of 11.1%.

Recognising that these changes would have a significant impact on the wine industry, the government put in place a transitional period, or temporary easement, which meant that all still and sparkling wines between 11.5% and 14.5% ABV should use an ‘assumed’ strength of 12.5% ABV when calculating duty to reduce confusion. However, it was confirmed on 30th October that the easement will cease on 31st January 2025. From 1st February 2025, the single amount of duty paid on wines between 11.5-14.5% ABV – £2.67 per 75cl bottle – will be replaced with 30 different payable amounts according to the strength of the wine now declared at 0.1% volume increments. The duty rates set on 1st August 2023 will also increase in-line with forecasted RPI inflation, which is currently estimated at 3.65%.

WHAT DOES THIS MEAN FOR ME AND MY BUSINESS?

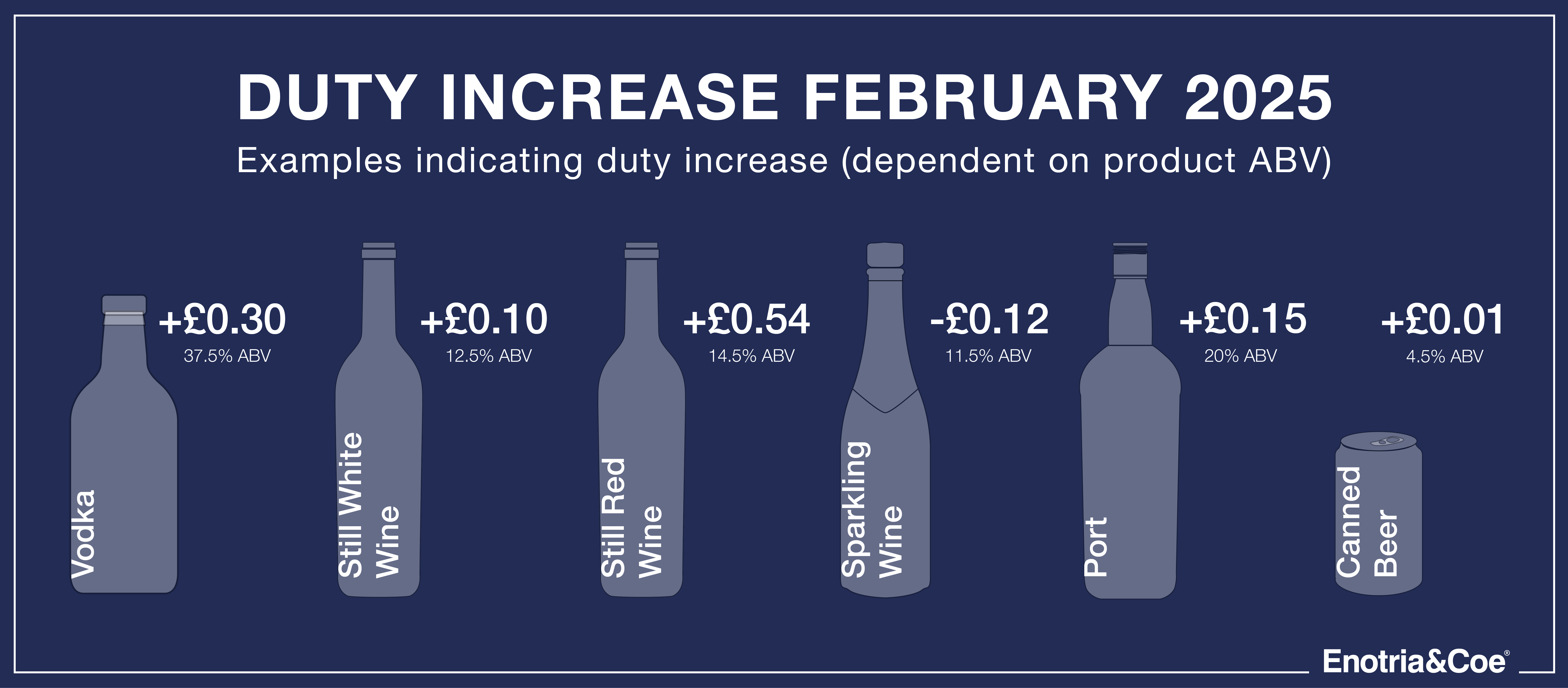

Simply put, on 1st February, alcohol duty will be going up once more, with still and sparkling wines increasing by an average £0.15 per bottle. The tables below provide snapshots of the impact on wines, as well as other alcoholic beverages, taking into account both the RPI increase and the end of the easement.

WINE

| ABV | Current Duty per Bottle (75cl) (Still & Sparkling - implemented 1st August 2023) | Duty from 1st February 2025 (75cl) Still & Sparkling | Difference |

|---|---|---|---|

| 8.5% | £1.82 | £1.88 | £0.06 |

| 9% | £1.92 | £1.99 | £0.07 |

| 9.5% | £2.03 | £2.10 | £0.07 |

| 10% | £2.14 | £2.22 | £0.08 |

| 10.5% | £2.24 | £2.33 | £0.09 |

| 11% | £2.35 | £2.44 | £0.09 |

| 11.5% | £2.67 | £2.55 | -£0.12 |

| 12% | £2.67 | £2.66 | -£0.01 |

| 12.5% | £2.67 | £2.77 | £0.10 |

| 13% | £2.67 | £2.88 | £0.21 |

| 13.5% | £2.67 | £2.99 | £0.32 |

| 14% | £2.67 | £3.10 | £0.43 |

| 14.5% | £2.67 | £3.21 | £0.54 |

| 15% | £3.21 | £3.32 | £0.11 |

*In this example we have used 0.5% ABV increments, but every additional 0.1% ABV will incur additional duty.

OTHER EXAMPLES

| Current Duty | Duty from 1st August 2023 | Difference | |

|---|---|---|---|

| Vodka (37.5% ABV, 70cl) | £7.54 | £8.31 | £0.76 |

| Pre-mixed Gin & Tonic (5% ABV, 25cl) | £0.36 | £0.31 | -£0.05 |

| Sherry (15% ABV, 75cl) | £2.23 | £3.21 | £0.97 |

| Port (20% ABV, 75cl) | £2.98 | £4.28 | £1.30 |

| Canned Cider (4.5% ABV, 44cl) | £0.18 | £0.19 | £0.01 |

| Draught Cider (4.5% ABV, 57cl/pint) | £0.23 | £0.22 | £0.00 |

| Canned Beer (4.5% ABV, 44cl) | £0.38 | £0.42 | £0.04 |

| Draught Beer (4.5% ABV, 57cl/pint) | £0.49 | £0.49 | £0.00 |

This duty increase takes effect in-line with when the wine and spirits industry usually releases their new annual price lists for the year ahead. So, what are your options ahead of 1st February 2025?

- Apply the duty increase on 1st February and update your wine lists or retail prices accordingly ahead of the deadline.

- If possible, build up your stock inventory ahead of January 31st 2025 to delay the price increase until March and review menus and retail offerings then.

- Make changes to your offering ahead of 1st February to include more lower alcohol wines, beers and spirits on your lists.

WHAT CAN WE DO TO HELP?

Your Account Manager is there to help as much as possible with this transition and will be able to advise on the best course of action for your business to ensure minimal disruption. Please do reach out to them if you have any questions.

Based on the information above, we are working proactively with our partner suppliers to explore lower ABV wines and other opportunities that Enotria&Coe can put in place to further support you and create value in the lead up to 1st February and will update further on this shortly.

“Despite much lobbying, we are disappointed that the government’s budget has not been as helpful as we had hoped towards the hospitality industry, and in particular, the UK wines and spirits sector. Ending the temporary easement of the duty legislation, together with the rise in overall duty in-line with forecast RPI inflation, will bring undue complexity and costs to distributors, retailers, restauranteurs and operators, and will ultimately negatively impact the end-consumer with inflated prices. Moving forward, Enotria&Coe are doing everything they can to help you, our customers, to navigate this change, and we will continue to work with the WSTA to campaign for more support for our industry.”

Julian Momen, Enotria&Coe CEO

For more information, please visit the government website